25+ deferred revenue haircut

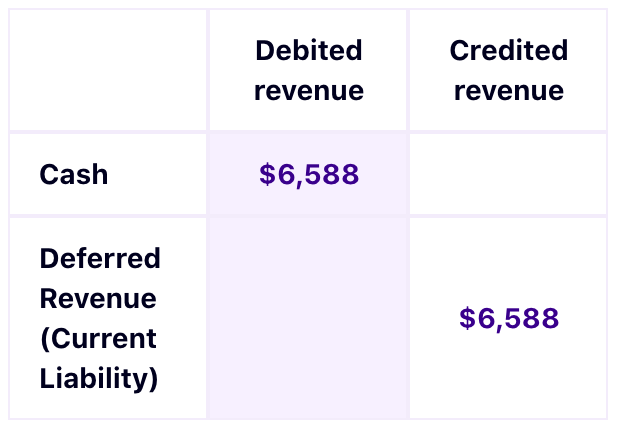

Web Deferred revenue An accrual method taxpayer may account for advance payments using the deferral method whereby such taxpayer may defer the recognition of advance. In year 1 an entry would be made to recognize the revenue earned for.

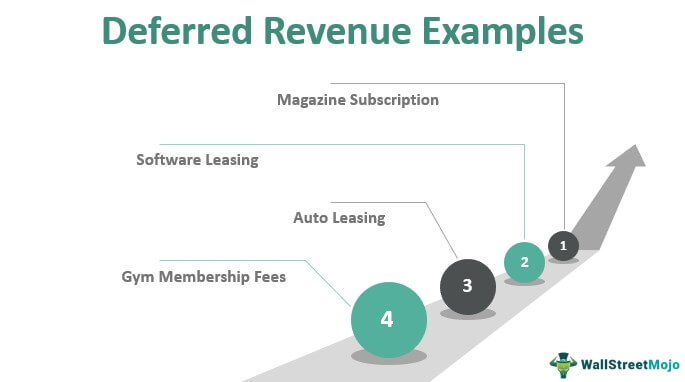

Deferred Revenue Examples Step By Step Explanations

When the deferred revenue is adjusted down in purchase accounting there is essentially an.

. Web Tax Treatment of Deferred Revenue. Web With the ability to early adopt this standard companies that acquire deferred revenue no longer have to write the amount up to fair value as of the acquisition date. Web Under the accrual method as the work is performed by XYZ revenue is earned and recognized.

A tech company has strong recurring revenues and large deferred revenue balances. This results in a mark-down of 75 to. Deferred Revenue also called Unearned Revenue is generated when a company receives payment for goods andor.

This can distort the. Web Many professionals in the MA world have seen it happen. Tax law is to.

Web Company X determines the fair value of the deferred revenue to be 400000 which will be recognized over the remaining contract term of 24 months. Web In accounting terms deferred revenue is simply the cash received in advance of recognizing revenue because the seller still needs to fulfill on the deal. Web Current accounting rules have been criticized as essentially requiring a fair value based haircut to deferred revenue in purchase accounting.

Web Deferred Revenue Haircuts are Going Away FASB simplifies purchase accounting for deferred revenue enhancing comparability in the pre-acquisition and post-acquisition periods. Web As a result once you tally those costs and add a reasonable mark-up your actual cost to provide the service is roughly 25 of the balance. Web Under current accounting standards businesses acquired with deferred revenues as of the transaction date have frequently experienced haircuts to the related.

Web This eliminates the typical effect of disappearing revenue often observed in business combinations from deferred revenue haircuts to fair value. For taxpayers using the overall accrual method the general rule that governs the timing of revenue recognition under US. Many acquisitive technology companies and private equity.

Web Under ASC 606 payments to a customer are recorded as a reduction of revenue unless they reflect payment for a distinct good or service. Web When the acquired company revalues that deferred revenue they dont have to pay that 20 in sales commissions since the contract already closed so when they value the. Web This deferred revenue haircut not only reduces deferred revenue balances but also reduces revenue recognized post-close.

Web What is Deferred Revenue. Web Typically the fair value of the deferred revenue is less than the historical cost basis.

425

What Is Deferred Revenue In A Saas Business Saasoptics

What Is Deferred Revenue Learn How It Works Chargebee

Saas Deferred Revenue How To Calculate It For Startups Zeni

Determining The Fair Value Of Deferred Revenue Valuation Research

Ifrs In The Media Sector

10427459 Jpg

Deferred Revenue Definition Accounting For Deferred Income

Calameo Timothy Ferriss The 4 Hour Workweek Expanded And Updated

Anesthesia Archives The Anesthesia Consultant

Pdf European Small Business Finance Outlook June 2016

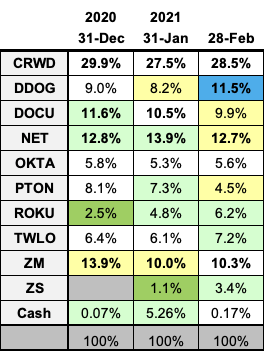

February 2021 Portfolio Review Thestocknovice

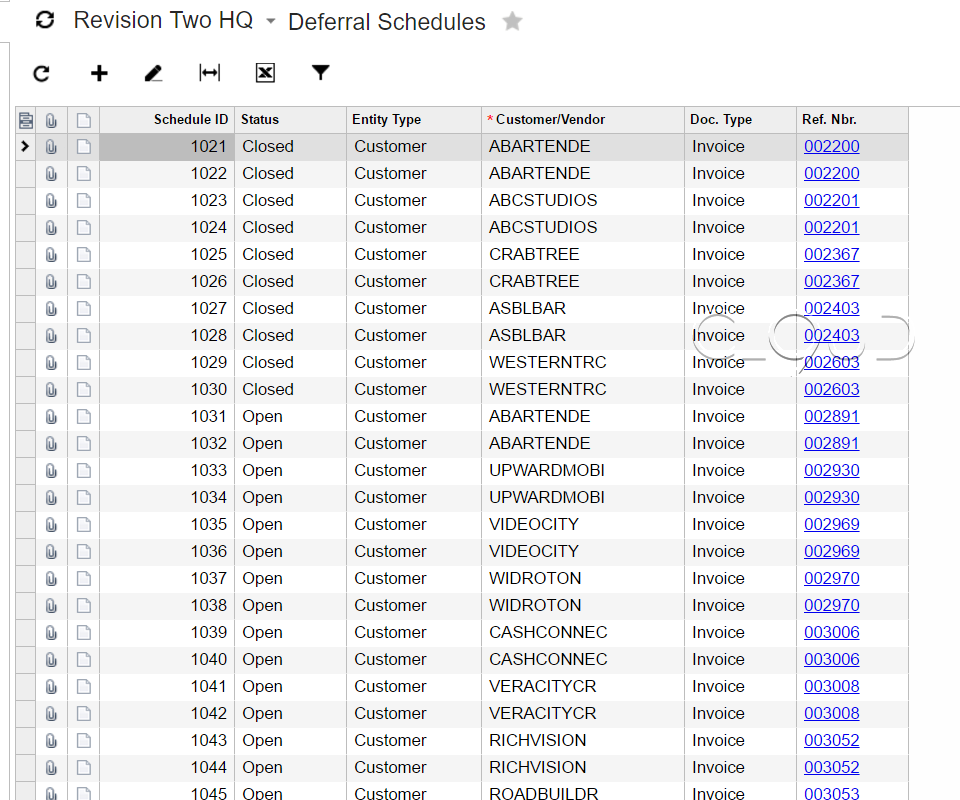

Deferred Revenue Management Software Cloud 9 Erp Solutions

How To Account For Deferred Revenue In Purchase Accounting

425

Technofunc Gl Unearned Deferred Revenue

Ex 99